Leading up to our talk at the Bristol Tech Festival, CookiesHQ is celebrating accessibility in a series of articles that addresses (and educates) accessibility in tech products.

Find more information about our event and how to attend here.

Accessibility is the extent to which the product is usable by people with the widest range of capabilities. This includes those with disabilities such as colour blindness, deafness or users with low or total lack of vision. You can read more about it here.

With 22 million people regularly using a banking app in 2017, it’s clear that banking apps are booming. Boasting easy money transfers, quick bank balance checks and the ability to manage money on the go, how accessible are they for customers?

Read about five mobile banking apps below…

Monzo

Monzo has taken a particular interest in the mental health of its users. In their words:

“Part of the role of a product designer is to consider features we could implement that may remedy the issues of our vulnerable customers”

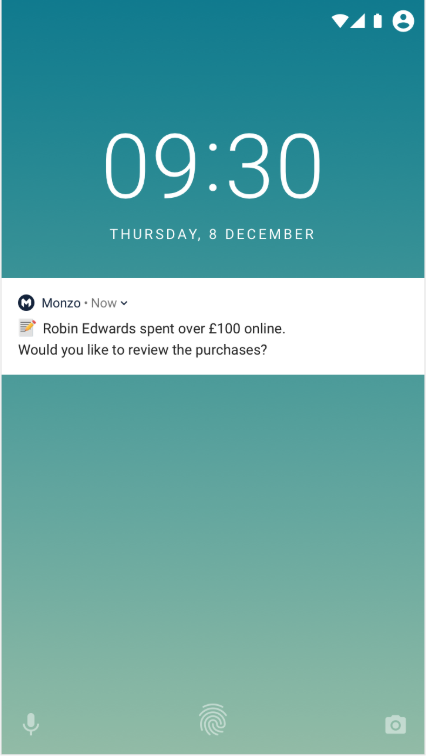

Research by the Money & Mental Health Policy Institute found that those with bipolar disorder had a tendency to overspend on needless items, most often at night, whilst in a manic phase. Once the morning, and with no way to cancel their spend, those affected with bipolar disorder could find themselves becoming more and more depressed at their declining bank balance.

This is why Monzo has suggested a method to double-check in the morning whether the customer would like to continue with the payment. This service would be available to either the sufferer or a carer such as a parent or trusted friend.

Although this service has not yet been released by Monzo, this is an interesting stance from the tech giant as to how banking apps can be more accessible for those suffering from a mental health disability.

Barclays Mobile app

With over 3.8 million customers using the Barclays mobile app, the implication of inaccessibility is significant for the business. From services for customers with dyslexia, dyscalculia and learning difficulties, to tools for people with mobility or dexterity impairment, Barclays has proven to be a bank that cares about making a service that is open to all.

Barclays’ banking app was awarded the AbilityNet Accessibility kitemark which means that it’s compatible with most accessibility features, like inverting screen colours on your device and voiceover technology.

We were mostly interested in their “Video Banking” which allows the blind or visually impaired (amongst other customers!) to call a member of staff any time from anywhere. Their extension SignVideo, allows customers to speak with an interpreter in British Sign Language (BSL) who can translate to a Barclays advisor.

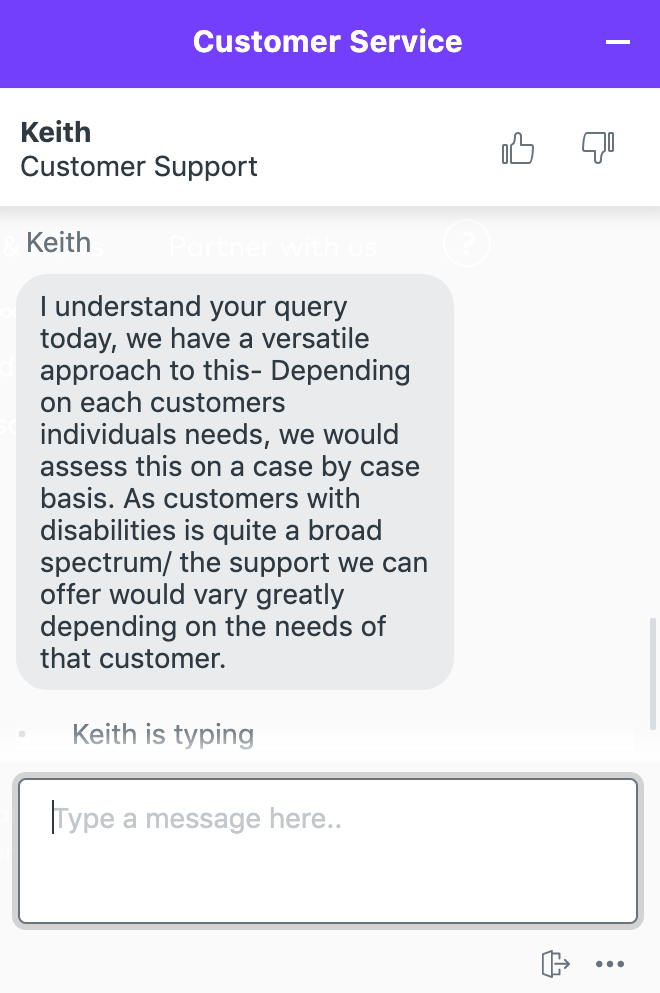

Starling

Unfortunately, there wasn’t much around about how Starling is making its product accessible for customers. But that doesn’t mean we couldn’t contact them directly to ask what they’ve been up to! When CookiesHQ got in touch with the business, the answers were vague to say the least: Although we understand that each customer will have different needs, it’s hard to pull the wool over our eyes: With over 460K accounts, we very much doubt that this company will be able to deal with every single customer’s product who has accessibility issues. When we pressed on for an answer, we were finally told:

Although we understand that each customer will have different needs, it’s hard to pull the wool over our eyes: With over 460K accounts, we very much doubt that this company will be able to deal with every single customer’s product who has accessibility issues. When we pressed on for an answer, we were finally told:

“At the moment, we do not have any accessibility features in-app; we rely on the customer’s using the software available on their mobile device.”

Amendment: We have since received a response from the head of communications from Starling Bank about how they are making their product more accessible. They mentioned that they worked alongside RNBI and Terptree to test their app, both of which work with people with hearing impairments.

They were also the first bank to introduce a gambling block to enable vulnerable customers and those with gambling addictions to block gambling and gaming transactions in the app.

Starling is also a strong campaigner for mental health and banking. Thanks for your answer Starling!

Natwest

Natwest has shown a concern for accessibility in many of its products and services. For example, the company launched an “accessible debit card” which has been specially designed to be easier to use if you’re blind or partially sighted.

The Natwest mobile app was developed in partnership with RNIB (Royal National Institute of Blind People). Steve Tyler, Head of Solutions, Strategy and Planning said:

“RNIB and NatWest have been working together to improve accessibility for their banking customers. Last year they introduced the first-ever accessible bank card and now, in partnership with RNIB, they have developed the first accessible banking app.”

This included features such as the “get cash” feature: if you’ve left your debit card at home you can get sent a code which you can read on the phone and input at an ATM to get cash out.

N26

In the words of Hugo Giraudel, front-end developer at N26:

“Accessibility online means offering the same content to everyone, no matter what their physical, cognitive or mental state is. Definitions vary but the principle remains the same. The aim is for everyone to be able to access our content and services.”

N26 have been busy building their platform from scratch with accessibility in mind. They are taking into account various accessibility issues such as animation. Indeed, customers with attention deficit disorder (ADD) or other conditions linked to movement may have trouble using content that uses too much animation.